The importance of German online retail – a study by IFH

What is the economic and social significance of online retail in Germany?

What is the economic and social importance of online retail in Germany? This is a question that is often the subject of emotional and controversial debate, especially against the backdrop of the (supposed) destruction of traditional retail structures. The current study “Value Creation in Online Retailing” by IFH FÖRDERER examines what contribution to value creation online retail actually makes. Read more here!

1. Online trade creates added value

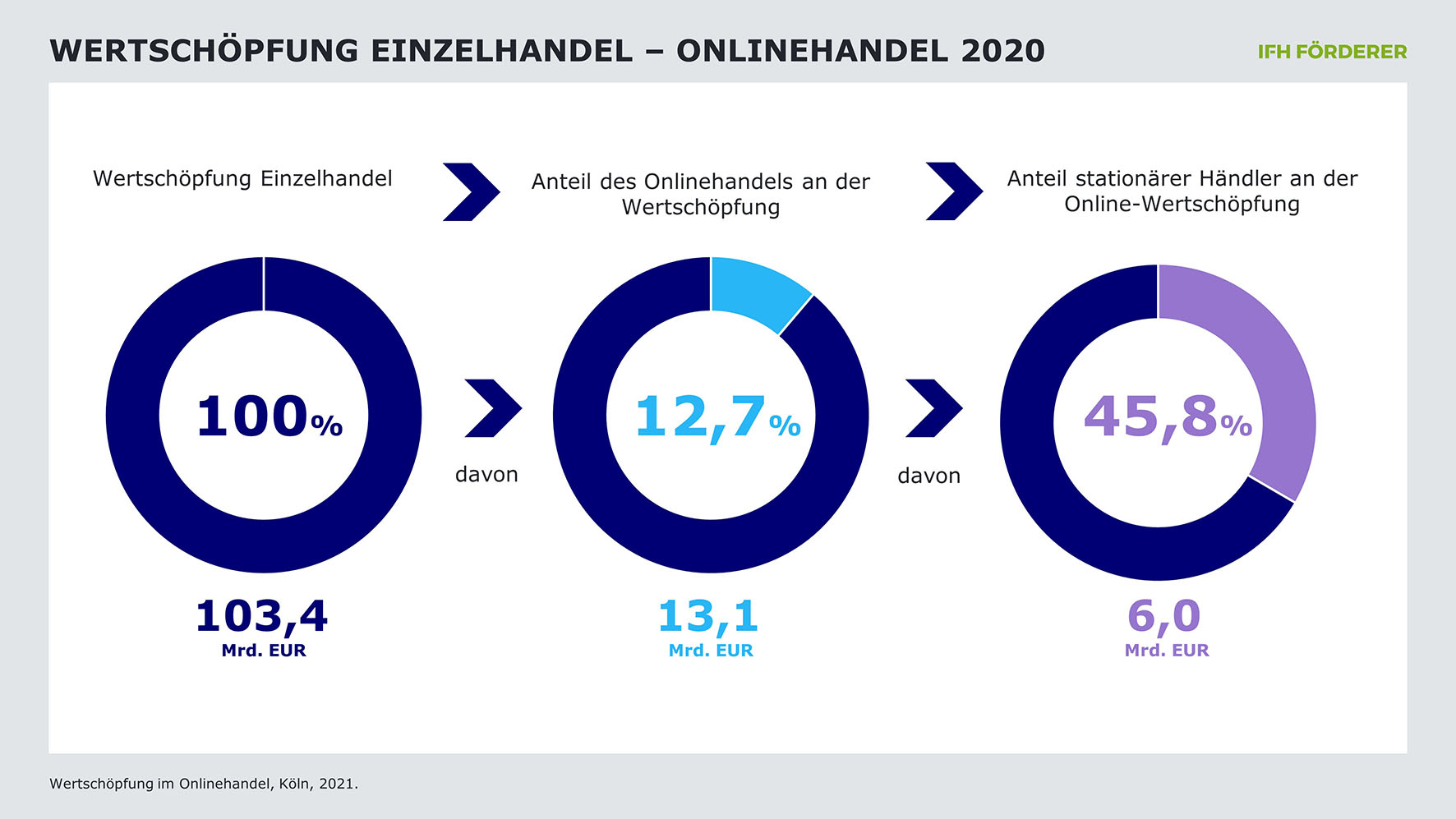

Value added, i.e., the net contribution to gross domestic product (GDP), is thus the direct contribution to the German economy. It can be seen that in 2020, B-to-C online retail will create a total of around 13.1 billion euros in value added, i.e. a share of 12.7 percent of the value added by the retail sector as a whole. Multichannel retail alone accounts for 45.8 percent of this online value added, or around six billion euros. The latter shows that the online channel is now firmly integrated into the stationary business. Stationary retail sales in 2020 amount to 578.2 billion euros and sales via online channels to 84.7 billion euros – that is 12.8 percent of total retail sales.

Compared with both the retail sector as a whole and online retailing alone, over-the-counter (non-food) retailers achieve the highest level of value added (24.7% of sales). At the same time, brick-and-mortar (non-food) retailers continue to participate only to a below-average extent in online value creation.

In addition to direct value creation, online retail naturally also induces indirect value creation in upstream and downstream sectors. At the manufacturer/producer and wholesale level, online retail will additionally realize indirect value added of EUR 6.1 billion in 2020. For the service sector, this is another 9.4 billion euros, 56.8 percent of which is in logistics services alone. This brings the total value added induced by online retailing to 28.6 billion euros – a very substantial contribution to the national economy.

In addition, online retailing activities create livelihoods and jobs. The number of online retailers is growing extremely dynamically, especially in recent years. The growth rate has doubled in the last two years alone and the number of online retailers now amounts to 39,632 in 2020 (from 22,279 in 2018).

This high importance is also mirrored from a consumer perspective. In a representative survey on the personal importance of online retailing, 77 percent (top 2 box) stated that online retailing was of great importance to the German economy and society. In addition, 80 percent agreed with the statement that online retailing was able to demonstrate its strengths particularly in the Corona lockdown.

This shows that retailing via the Internet is now firmly established and it is hard to imagine the economic fabric without it. E-commerce has thus become a firm pillar in the economy and in the retail sector.

2. online stores of multichannel retailers significantly support the store network of the large chain stores

In the non-food sectors, multi-channel retailing is now the most important form of distribution in the retail sector, and growth is huge with a CAGR of just under ten percent in 2010-2019. Just under a third (32.7%) of retailers will still not (yet) have their own online store in 2020. This percentage was 53.9 percent in 2010. By comparison, 52.6 percent of retailers were pursuing a multi-channel strategy. However, according to our projections, multi-channel retailing will also suffer a drop in sales in 2020, as with a few exceptions it was affected by the shutdown. Although companies are shifting sales to online retail, in many cases this will not be enough to compensate for the loss of stationary sales.

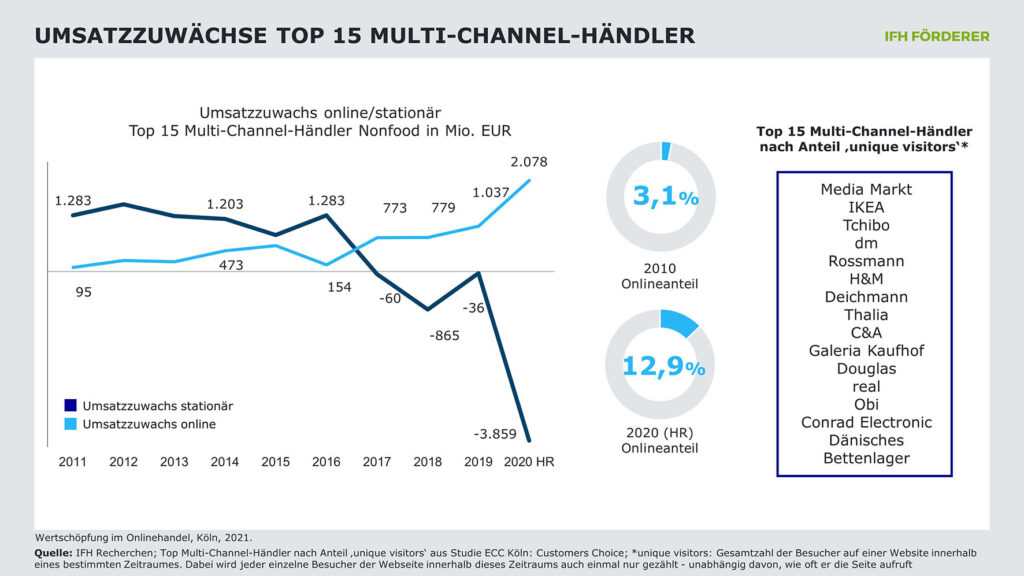

The dynamics of sales development in the various channels is interesting. For the top 15 multi-channel retailers (see Fig.), the stationary channel was the main driver of sales growth until 2016. Although online business also generated sales growth, it did so to a much lesser extent. This situation has reversed since 2017. From that year on, the stationary sales growth is clearly negative while the online channel virtually single-handedly carries the entire sales growth. Part of the problem in the stationary business is, of course, the loss of foot traffic.

The development during the pandemic reinforces this effect and this is also confirmed by consumers. Around 68 percent of those surveyed for the study state that they ordered products online in the lockdown in order to subsequently pick them up in the local store (click & collect). Around 38 percent confirm that they would have bought fewer products in the Lockdown without online retailing. In this respect, it is clear that online retailing has become the key support for the store network of multichannel retailers.

The experts we interviewed also overwhelmingly agree that the online store is now a very central component of the multichannel retailers’ business. At the same time, the stores are increasingly assuming other important functions in the customer dialog. Mark Sievers (Partner, Deal Advisory, KPMG AG), for example, finds that multichannel retailers have shown that channel integration is superior to purely stationary retail. “Thus, the multichannelist has helped the stationary sales channel via its online channel and, for example, mitigated worse effects in combination of online ordering and stationary pickup and supply (Click & Meet) or even service (repair acceptance).”

The pandemic has also impressively shown that it is mainly retailers who have “taken digital precautions” that are successful. Since for many a short-term technical and organizational conversion is hardly possible, those companies that have already gone through this transformation were effectively rewarded.

3. platforms support small business retailers

Marketplaces are significantly changing the structures in online retailing and continue to be of great importance. Marketplace companies such as Amazon, Zalando and eBay have already had a massive impact on value chains in retail. Established companies such as Otto, Douglas and Fressnapf are jumping on the bandwagon with major investments. In 2019, Amazon Marketplace alone accounted for 29 percent of online sales (19 percent additionally for the company’s own business) and a further nine percent for other marketplaces, these being eBay, Zalando, About You, Otto or Douglas. The importance of the marketplace has grown significantly for Amazon and has long since exceeded its own business. In the corona year 2020, marketplaces also realized a leap in growth. Projections by IFH KÖLN assume a significant increase in market share for Amazon alone to 33 to 34 percent.

In recent years, more and more smaller providers, often rather assortment specialists or “category killers,” are entering the business and becoming “marketplaces.” For example, Manomano in the DIY sector, The Platform Group (schuhe24, taschen24, etc.) or Fressnapf for the pet sector. The aim is always to cover an entire category of customer needs and to become the first port of call for a broad and deep range of categories.

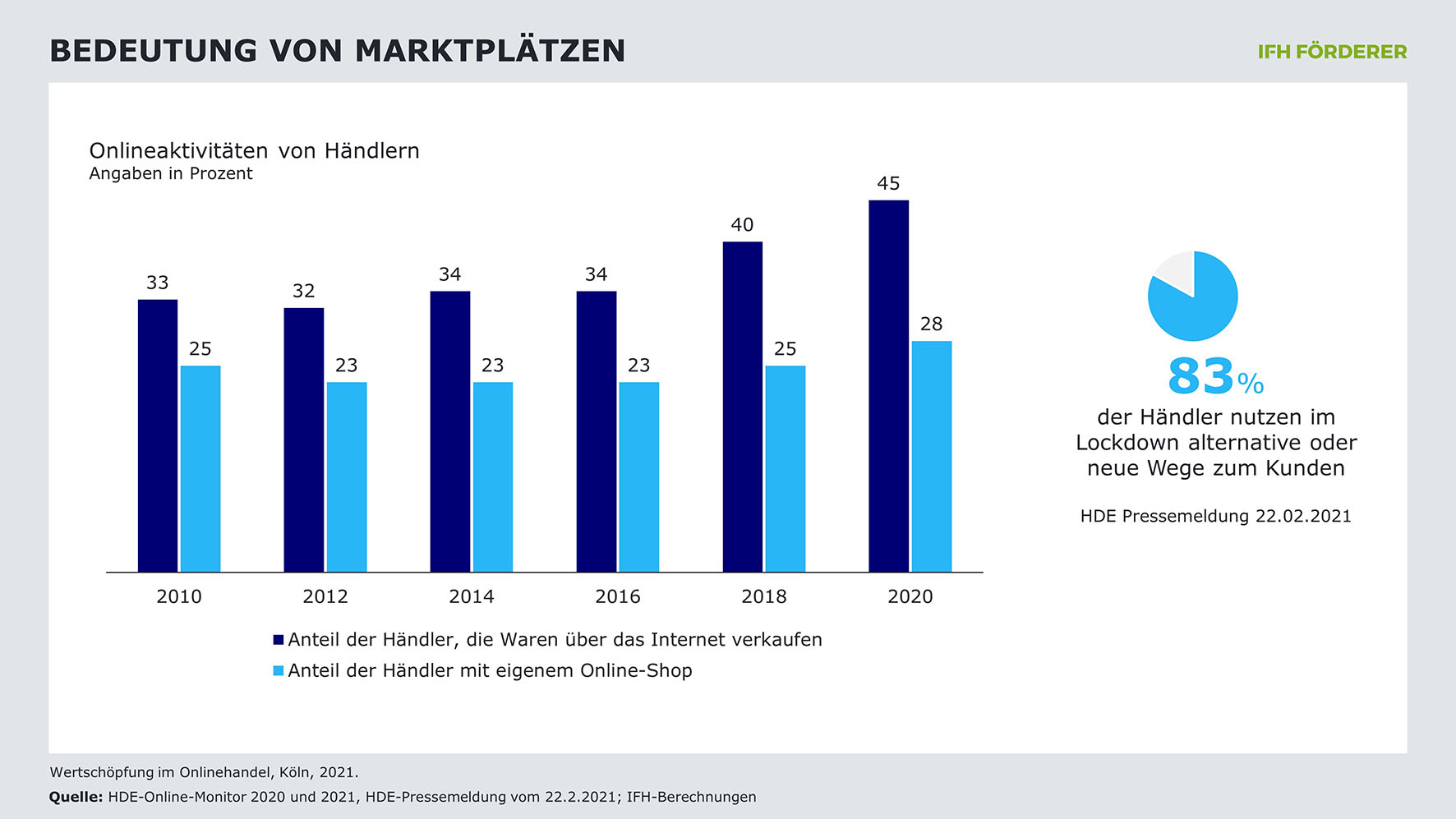

In addition, marketplaces offer online leverage to smaller retailers in particular, and the number of retailers with a presence on marketplaces is not only growing significantly, but has long since exceeded the number of retailers with their own online store.

Marketplaces offer a ready-made technical infrastructure and access to a large customer base – which is of course extremely advantageous from the point of view of a small merchant. This attractiveness can be traced in our figures. In 2020, for example, 45 percent of all retailers will sell online but “only” 28 percent will do so via their own online store. Marketplaces are the first port of call for a retailer before investing in their own technical infrastructure. Christoph Eltze, Divisional Director Digital, Customer & Analytics, at REWE also sees it this way: “It will probably be very difficult for smaller retailers to completely avoid platforms in the medium term.”

The (large) marketplaces, which are highly attractive from the customer’s point of view, can hardly be avoided if one wants to have access to many consumers. Yet using marketplaces is not without its challenges. The easy comparability of products leads to a strong price focus. In addition, identical (branded) products are offered online by many providers, which in turn promotes price competition. This makes it difficult to differentiate one’s own retail profile. And last but not least, more and more manufacturers are moving to the marketplaces to operate there as part of their direct-to-consumer strategy. The retail level is being bypassed. This is also confirmed by Dr. Stephan Zoll, CEO SIGNA Sports United: “I believe that the big brands will try to do business on the big marketplaces themselves as well – so the small, non-specialized retailers will then be less relevant.”

At the end of the day, it remains for retailers to weigh the pros and cons of each platform: potentially high volumes versus market transparency and price competition. Differentiation via the product range (keyword: private label) is one of the keys to success here.

4 Online retailing enables small retailers to tap into global sales markets

Retailers are generating increasing sales from abroad. The lever for exports is digitization.

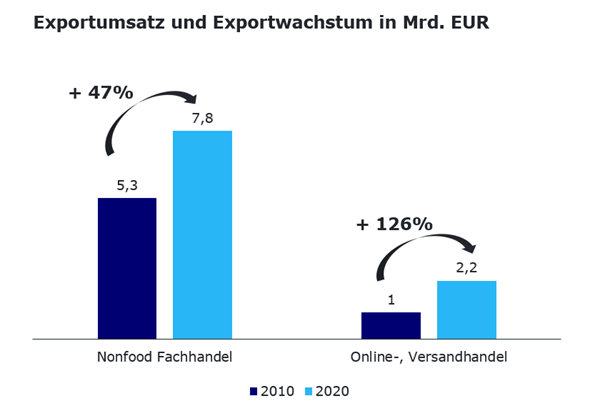

The export ratios of the individual retail sectors reported by the Federal Statistical Office as part of the sales tax statistics range from one to 15 percent. Export rates are particularly high in the non-food retail sectors, above all in the retail sector for leather goods, luggage, art objects, antiques, medical items and textiles. These sales are strongly facilitated by online trade. Analogous to the sales development, the export growth of institutional online and mail-order retailing (pure play) alone is 126 percent between 2010 and 2020 and has thus more than doubled.

The Amazon platform is not an unimportant lever here. For example, Dr. Markus Schöberl, Director Seller Services Germany at Amazon, announces that in 2018, small and medium-sized enterprises (SMEs) selling via Amazon generated 2.5 billion euros in sales from abroad – 20 percent more than in 2017.

Of course, selling abroad is not a no-brainer: for example, customs regulations, language barriers and legal issues were repeatedly cited as hurdles in the expert interviews we conducted for the study. Likewise, many retailers probably fear competition in the international environment. On the other hand, selling within the EU is largely standardizable. Selling in border regions also offers advantages due to short distances and possible price differentials. In particular, the experts see specialized niche markets as attractive opportunities to initiate a buoyant trade abroad.

Thus Bastian Siebers, chairman of the management board of babymarkt.de GmbH, sums up: “Online trade offers sales structures that are directly able to offer not only in the small limited market, but Europe-wide, perhaps even worldwide. This is an undisputed added value that can be offered by these structures nowadays.”

5. online commerce is an innovation driver for the retail industry

The retail industry is undergoing a fundamental transformation in the wake of digitalization. Structural change in retail is taking place at high speed – Corona is acting as an accelerator. Changed forms of supply are bringing about a change in consumer behavior; above all, the demands for simplicity and speed in purchasing and information processes are changing. Online retailing is driving innovation in many industries and has triggered a change in perspective, and not just in terms of customer-centric thinking.

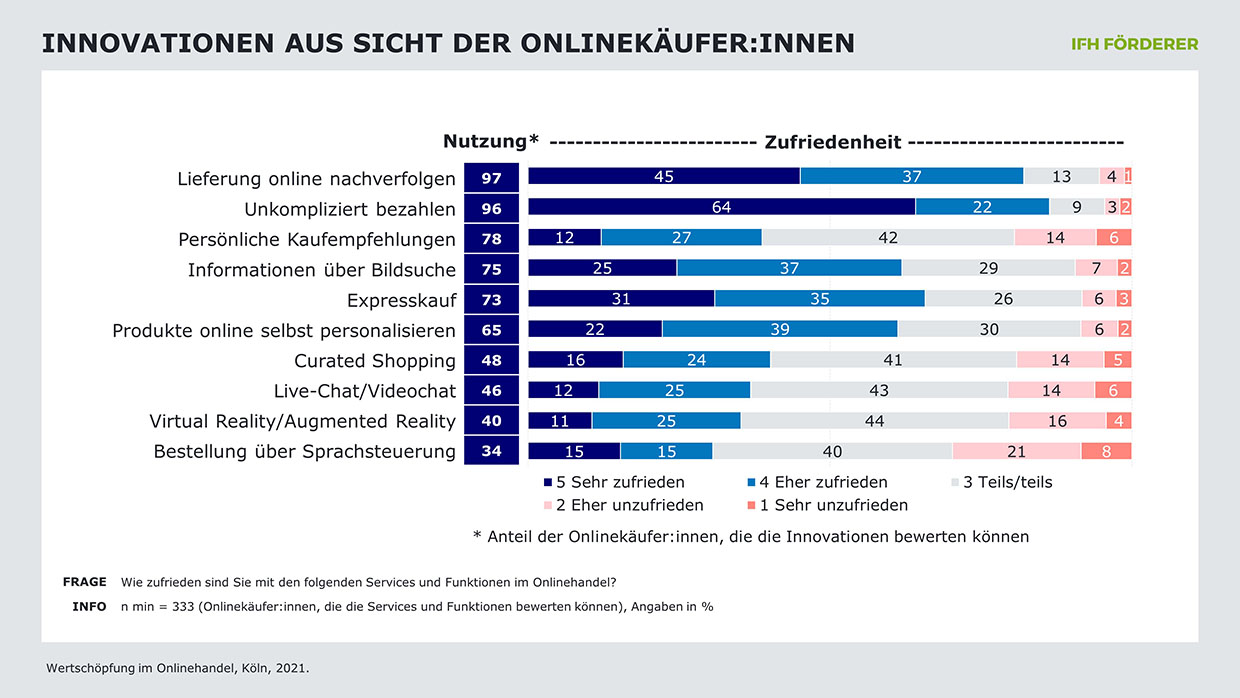

The innovations brought about by online retailing are perceived by consumers as relevant and positive. Consumer behavior is currently still strongly dominated by convenience. Convenience-driven services – especially in the purchase and post-purchase phase – are therefore also in the focus of shopping-relevant technologies. Live tracking and uncomplicated payment methods are by far the most frequently used services, followed by image search, express purchase and product personalization.

The expert interviews conducted for the study add important facets to these survey results. The predominant view is that innovations begin in e-commerce and spread from there to other retail areas. The convenience benefits of e-commerce have fundamentally changed the retail sector. The convenience disadvantages that have arisen have forced stationary retailers to invest in stores in order to improve the experience and thus increase attractiveness (and innovation). Digitization as the real driver of e-commerce is leading to new products, new ways of working and innovation in general. Social media is seen as another driver of innovation.

According to the experts, the obstacles to innovation for bricks-and-mortar retailers include the structure and organizational setup of bricks-and-mortar retailers as well as digital identity and the culture of innovation. It is important for stationary retailers to show a willingness to integrate innovative approaches into existing business models.

Christoph Eltze, Divisional Director Digital, Customer & Analytics at REWE Group, sums it up as follows: “With online retailing, companies naturally create the entry into digital topics. In the future, digital innovations will be used in the same way in traditional brick-and-mortar retail.”

6. online trade creates employment

In terms of employment and the labor market, online retail is often given a poor report card. Wrongly so! The reality is different.

Firstly, online retailing creates jobs overall. This is made clear by the employment figures in the trade statistics of the Federal Statistical Office. These include the online/mail order business. According to these, the number of employees in the online/mail order business has increased by 142,000 (2010-2020 HR). Because the increase in total retail (i.e., including online retail) is only just under 93,000, in other words, this means that stationary retail has actually shed employees.

Secondly, it is repeatedly discussed that online retail tends to employ lower-skilled workers. The data from the German Federal Employment Agency for 2020 make it clear that online/mail order retailing does indeed employ an above-average number of helpers (i.e., people with no formal training) in relation to its total workforce, but it also employs an above-average number of specialists and experts (with degrees from technical colleges and universities). The online retail sector employs an above-average number of people with academic degrees who are subject to social security contributions (compared to the retail sector as a whole). In total, only 6.7 percent of all retail employees work in online retail, but 19.6 percent of all retail employees have an academic degree. Bastian Siebers, Chairman of the Management Board, babymarkt.de GmbH, agrees: “I don’t share the view that staffing needs are predominantly recruited from ‘lower’ qualified workers. A look at our company reveals rather the opposite. It is certainly true that we have employees in the service center and in logistics who do not necessarily have an academic background. However, in most other professional fields, studies are the standard rather than the exception.”

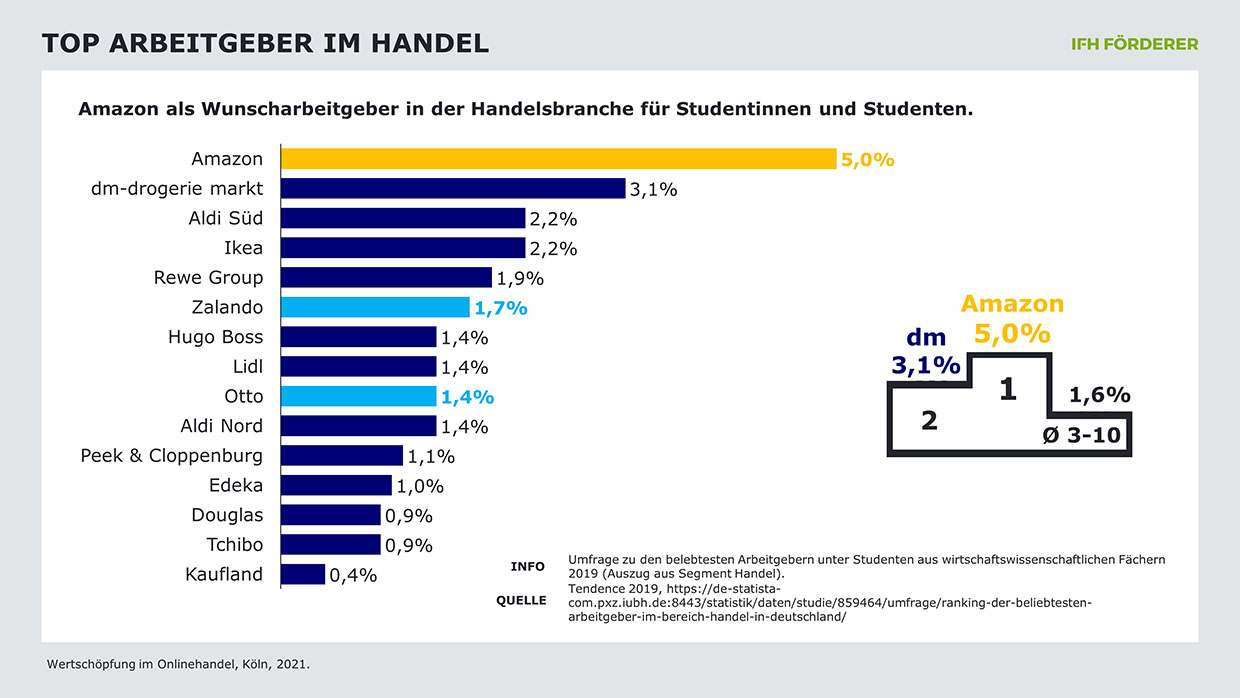

Third, online retailing is, among other things, a sought-after employer among students and young graduates of economics. Amazon has been the top employer of choice for graduates for years.

Fourthly, the thesis that online retailing creates jobs is largely confirmed by the experts surveyed. They emphasize that the requirement profiles and job descriptions are changing accordingly. In their opinion, the areas of highly qualified jobs (e.g., data analyst) in particular are growing.

7. Online retailing meets customer needs for convenient supply

Online purchases, not only due to COVID-19-related store closures, have become increasingly popular in recent years. According to Eurostat, 87 percent of Internet users in Germany made purchases online last year. This is the third-highest figure in the EU and a further increase of five percentage points in a five-year comparison.

In our representative survey, online shoppers attribute a very high level of personal importance to online retailing and the majority state that online retailing is there for them at all times (top 2 box: 83 percent) and everywhere (73 percent).

In addition, 78 percent are glad that online retailing exists, 62 percent can better balance their work and private lives thanks to online retailing and 57 percent cannot imagine life without ordering online.

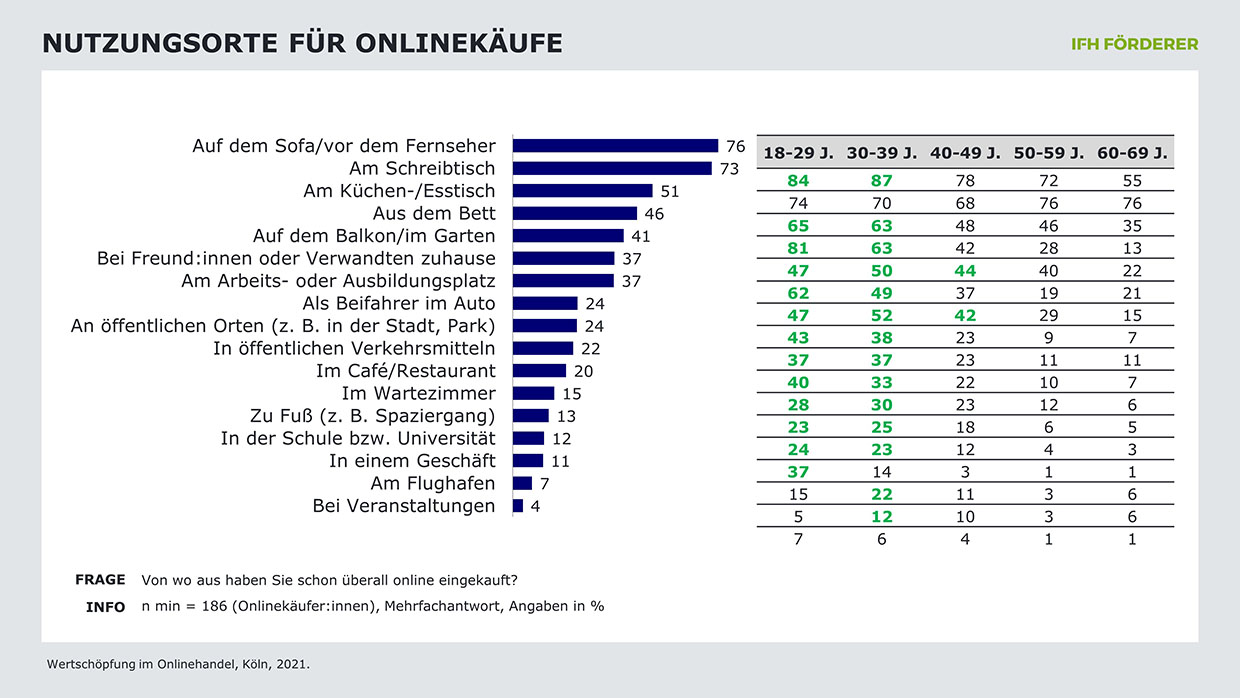

We also surveyed the places where online purchases are made (i.e., real transactions and not just information searches). This shows that online commerce is penetrating almost all areas of life. Naturally, the majority of purchases are made from a desk, kitchen table or sofa. However, the high personal importance is also reflected by the fact that 18-39 year-olds in particular buy online from almost anywhere, especially while on the move. This means that purchasing as such has already arrived and become anchored “in the middle of life” for this group.

The occasions for online purchases have also become increasingly diverse. For a long time, for example, these were usually more need-oriented and targeted, while inspiration and unplanned purchases were more reserved for shopping in stores. Today, this distinction is becoming increasingly diluted. It is true that target purchases still dominate online: 90 percent of online shoppers make planned purchases online at least once a month. In addition, 73 percent “browse” online at least monthly. By comparison, only one in two Germans goes shopping or window shopping at least once a month.

These developments are also confirmed by the experts interviewed. For example, Michael Mette (Deputy Managing Director, IKEA Deutschland GmbH & Co.KG) says: “Online retailing is doing a fantastic job of satisfying customer needs for convenient supplies.”

8. online retail is more sustainable(er) than its reputation

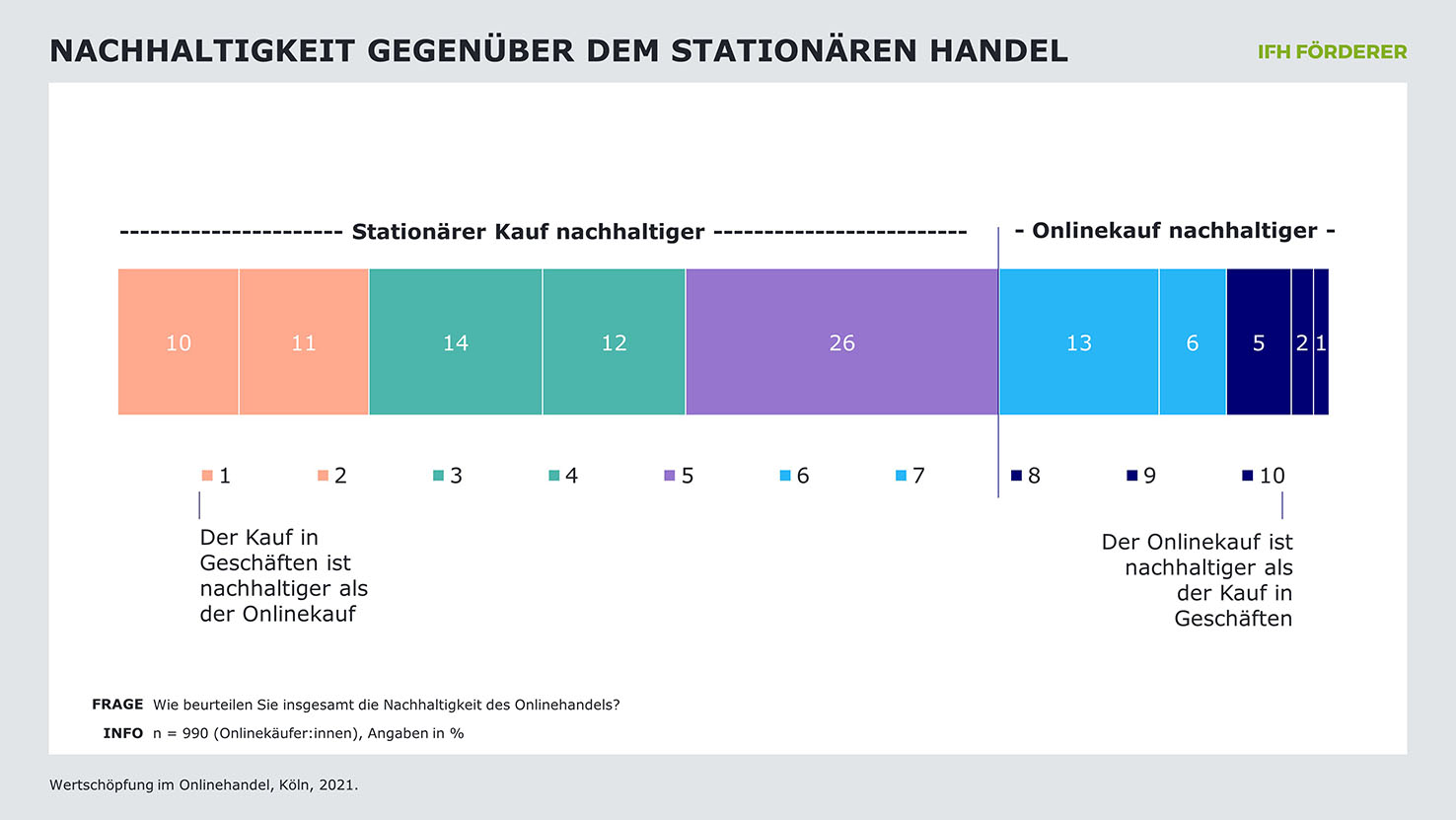

The ecological impact of online retail is often discussed emotionally and almost universally controversially. The overwhelming perception is that online retail as such has a negative ecological image. Furthermore, the popular opinion is that online retail leaves a larger ecological footprint than brick-and-mortar retail. This perception is also reflected in our consumer survey. While 27 percent of respondents believe that online retail is more likely to be sustainable, 73 percent believe that it is not.

A closer look shows that the focus is mostly on a singular consideration of delivery on the ‘last mile’. However, a complete examination reveals a different picture. Our analyses are based on a comprehensive review of published quantitative studies on the subject.

When all retail formats are considered, it can be seen that in the entire consumer goods value chain (here the categories FMCG, books and electronic products), the share of the retail stage in CO2 emissions is manageable (5 to 22 percent of total emissions) compared to product manufacturing, use and disposal.

In the three categories considered – FMCG, books and electronic products – online retailing consistently generates significantly lower CO2 emissions. The latter amount to approximately between 25 and 40 percent of stationary retail. Based on the studies evaluated, online retailing is thus ecologically more advantageous. Interestingly, this information about the actual environmental impact has apparently not yet reached consumers.

The interviews with experts from the retail sector reflect the very complex topic of sustainability impacts. There are many facets to the discussion. Overall, the average level of agreement and disagreement with the thesis was balanced. A final evaluation is not possible at this point, but it is clear that the myth of environmentally harmful online retailing is not tenable.

In addition, some of the experts interviewed noted that the aspect of sustainability is better anchored in the self-image of digital companies – although this may well have something to do with the comparatively younger customers and workforce. According to Dr. Stephan Zoll (CEO SIGNA Sports United), “I believe that many digital companies now have a higher level of environmental awareness. Not least because consumers are also demanding and valuing it more in the digital industry.”

Conclusion:

Overall, we have tackled a very controversial and complex topic with the “Value Creation in Online Retail” study. The diverse reactions show us how important the associated discussion is. With the due neutrality of the university institute, we carried out the extensive analyses and made the corresponding results available to the public. Only through the support of the Otto Group was it possible to select an appropriately comprehensive investigation approach that does justice to the complex subject matter. We are therefore pleased to have provided a further basis for a well-founded and data-based discussion on value creation in the retail industry.

Click here for the original article!