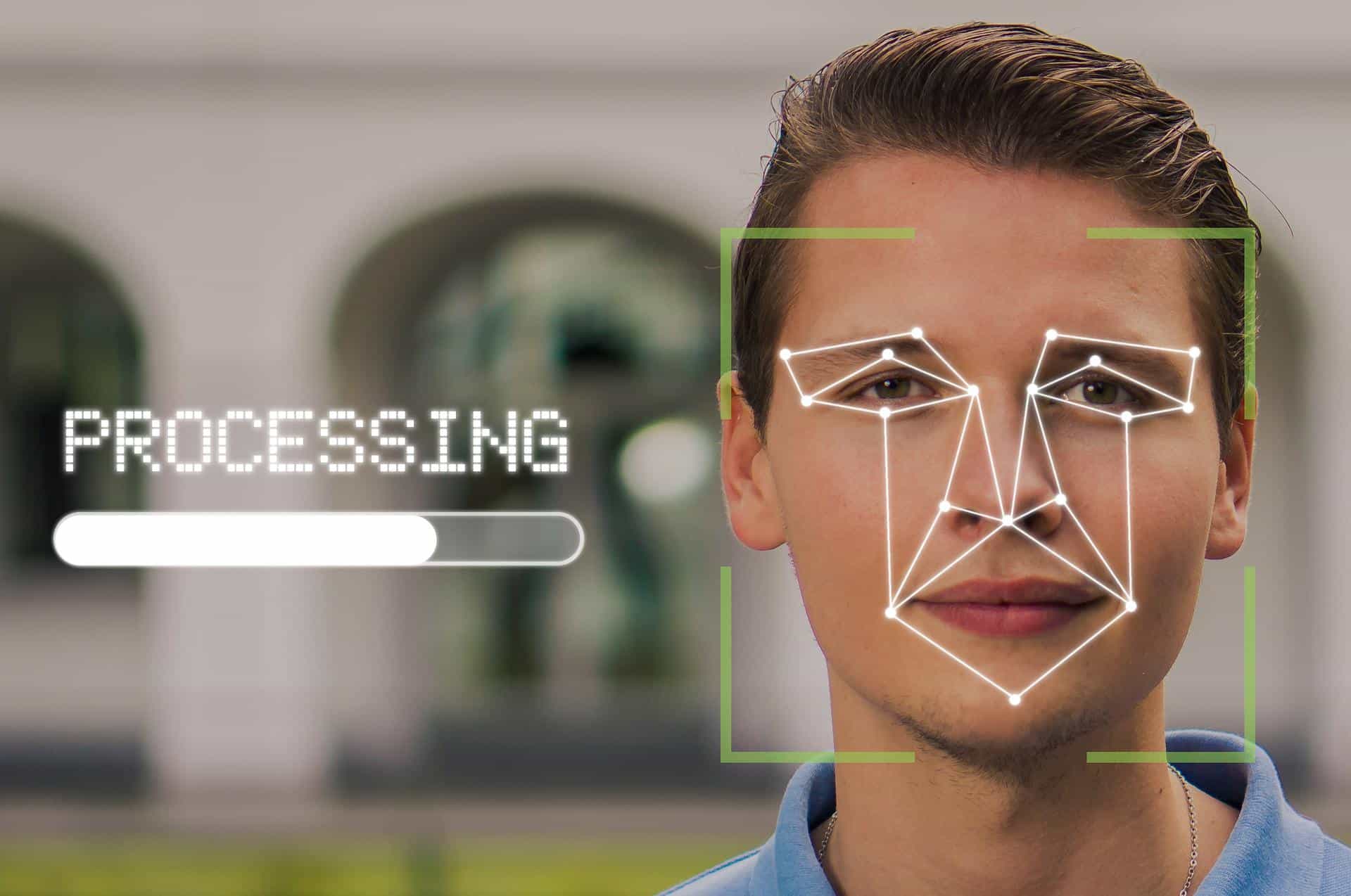

Paying with your face: Why more and more brands are investing in biometrics

Biometric authentication solutions are slowly gaining ground in more and more areas. Read below as to what is lacking and why they will still permeate our everyday life.

The number of case studies in public space is increasing and by no means only in China: biometric authentication solutions are about to conquer everyday life. The fact that it hasn’t come to that for a long time is ultimately due to technological issues.

“Whether you identify yourself at the supermarket checkout using your fingerprint, your face or your iris should depend primarily on whether you want to. The technology for this has long been ready for use,” says Andreas Wolf, Principal Scientist Biometrics at Bundesdruckerei in Berlin . “Their deployment will depend on audience acceptance, expected cost and expected commercial benefits.”

In the pillory: The matter with the advertising photo on the bus

However, the latter is sometimes so seductively high that biometric solutions are sometimes used without the last security check – which, in the event of corresponding negative reports in the press, automatically leads to renewed reluctance on the part of the public. It is a constant back and forth that allows biometrics to seep into everyday life only slowly.

It’s not even the worst horror stories that cause the most violent setbacks. When zebra crossings are monitored in China and passers-by who cross the street when the light is red are literally pilloried by digital photos, this causes such huge shock waves in our latitudes that even politicians react.

The case: some time ago in Ningbo, a photo of the well-known entrepreneur Dong Mingzhu was projected onto a huge billboard with the information that she had just committed to an offence. Dong Mingzhu didn’t even cross the street when it was red. The surveillance system’s artificial intelligence had mistakenly picked her promotional photo from a passing bus. The EU Commission, therefore, wants to prevent such attacks in advance.

In April, she published a legislative proposal that “in particular allows all types of biometric remote identification systems,” ie cameras, only under strict conditions and “fundamentally” prohibits “their real-time use in public space for law enforcement purposes.”

No Go: Face recognition in the supermarket

The fact that people can feel free from such reprisals from the state is only one side because it is the undisputed one. Uncertainty, on the other hand, must always be triggered by the advance of the private sector. If companies expect great advantages from biometric solutions, they take a chance. legal regulations or not – if they exist at all.

For example, last year the Spanish supermarket chain Mercadona began equipping 40 branches with facial recognition software to filter out banned people and prevent them from shopping. However, without exception, all customers were recorded, even if their photos only stayed in the system for a few tenths of a second, according to the company’s assurance, just long enough for them to be compared with the database.

However, the Audiencia Provincial de Barcelona, the highest court in the city, found it too much. Two weeks ago, Mercadona banned any further use of facial recognition in its branches. The accusation: invasion of privacy. There was a small information leaflet at the entrances – but nothing more.

Go: facial recognition in the stadium

There is a similar case in Denmark. Brøndby IF are the first club in the world to use face recognition as access control in their stadium. The reason: about 100 unwanted people. Identifying these fans from among 14,000 home game fans was always a major challenge for the security staff and caused considerable delays in admission. With special cameras and the Face Pro software, Panasonic ensures a significantly more comfortable visit to the stadium.

Again: Panasonic assures that no photos are saved by people who are not on the club’s black list. The difference to the Mercadona case: The association has obtained the approval of the authorities for the use of facial recognition. Their reasoning was that in the fight against hooligans it is allowed to use facial recognition because it is in the public interest.

No monopoly expected

Biometric authentication seems caught in a tangled web of private and public interests. However, it does not have to be about the absolute claim of a new technology that wants to replace an old 1:1. Michael Ginsberg, CEO of Toronto-based e-mail encryption specialist Echoworx, recently drew attention to himself by saying that a password-free society is the future when he announced that he would henceforth rely on biometric authentication solutions.

For Andreas Wolf, biometrics specialist at Bundesdruckerei, this is the wrong approach: “For reasons of data protection and user acceptance, biometric solutions should only be one of several alternatives. It doesn’t necessarily have to be about completely replacing passwords. Depending on the demands on an application, authentication systems based on knowledge, possession and biometrics or on a combination of different characteristics will coexist on an equal footing.”

Wolf expects that there will always be customers who prefer to pay in cash for the simple reason that they don’t identify themselves with it. The development can be seen in the media explosion: every new medium is added to the previous one, none replaces another, they exist side by side. TV, radio and print are losing market share, but the Internet has not abolished them.

Likewise, there does not appear to be a monopoly position in the payment market, and streaming or pay-TV are additional offers, not ones that are displacing other moving-image media. Whenever a new technology offers clear benefits that are immediately apparent to everyone, it will be embraced by the mainstream. And biometric authentication solutions offer plenty of them, with the exception of cases of misuse.

For example in the supermarket: pay by laying on hands? No problem: Amazon makes it possible – if only as a pilot project in Seattle. A scanner at the entrance identifies customers via the palm of their hand and links the biometric data to their credit card and mobile phone number. These can then be quickly activated later when checking out.

Or when driving: the new S-Class from Mercedes opens the personalized display in the interior using fingerprint or face recognition.

Continental and Hyundai are working on opening car doors using biometric authentication. In the future, engines could also only start with the right fingerprint across the board – a double anti-theft device.

Identify with the smartphone

The number of potential applications is almost limitless. Wherever people have to identify themselves in order to access certain services, biometric systems have their place.

For example on computers with access to sensitive data. “How does a call center know that the authorized person is actually sitting in front of the screen?” Gereon Tillenburg, Managing Director of the Darmstadt-based biometrics specialist Twinsoft, outlines an everyday usage situation.

“We developed a solution and integrated it into our biometric management suite BioShare. A QR code appears on the screen at random intervals, which the employee has to photograph with their smartphone in order to be able to continue working. Its data is stored in BioShare , so that the owner’s fingerprint or face can be identified.

Even authentication on the Internet – often associated with scanning documents – will soon be much faster and easier: one click is enough.

“Probably from autumn of this year, citizens will also be able to identify themselves online with their smartphones – but this digital proof of identity is not intended as a visual or travel ID,” announces Andreas Wolf from Bundesdruckerei.

And the numerous control processes when traveling should also be much more pleasant in the future because they run smoothly.

Travel without a passport

“In the near future there will certainly be the first prototypes for a mobile and later also a virtual passport in some countries,” says Wolf. “Standards that enable international interoperability of mobile and virtual passports are currently being developed in the community. It is not yet possible to judge how quickly this virtual passport will be used.”

What is missing is high-quality biometric reference data. Demanding this from the entire population, ideally worldwide, will certainly take quite a while, probably more than ten years. Processes of this magnitude usually take decades to complete.

But at some point the time will come and passport controls will be completed quickly with a nice smile at the camera, without any physical ID checks.

“The border control authorities at the travel destination have all the biometric passenger data available long before arrival,” explains Wolf, “and then use the camera to compare it with the traveler’s face.”

In principle, the prospects for the biometrics industry are good (and they will be even better if laws everywhere make it clear who is allowed to do what and where with which data). So it’s no wonder that the willingness to invest in the economy has risen sharply in this regard, at least according to the results of a recent survey by the London consulting firm Goode Intelligence.

Almost three-quarters of the 220 respondents from business and government circles around the world said that biometric authentication solutions are fundamentally very suitable for their organization to ensure a good customer experience. Over a quarter have recently increased their investments in this area and around a third are now more inclined than ever to use biometrics.

A smile is enough

The solutions range from face or iris recognition, and fingerprints to palm vein recognition. Even behavior-based authentication is being researched extensively. In particular, the way someone typically types can be analyzed and used for secure authentication. But the way you walk is also individual and could be used as a new authentication method, for example at airports or other access points. This means nothing other than that a new industry is emerging here, which only lacks the first unicorn to switch from the trend to the boom phase.

Or is it growing up? The Romanian biometrics app PayByFace is causing quite a stir in the Balkans. Instead of paying with cash, credit card or smartphone, in some places, you can simply pay with your own face. For this to work, the user only has to download the app, take a selfie with it and enter their credit card details – they will then be recognized by the camera of a PaybyFace tablet at the counter (and after entering the four-digit PIN ). The Bulgarian subsidiary of the Austrian Raiffeisen Bank has installed the system in the café at its headquarters in Sofia, a taxi company in Bucharest is currently trying it out, and the coffee shop chain Ted’s is also involved. A total of around 70 locations in Southeast Europe are currently using facial recognition paid. And maybe soon with us too.

Click here to read the original article.