Why technology competence is a growth driver for companies

Companies that use technology strategically to achieve their business goals have a positive growth forecast for this year. That’s according to a new study by ThoughtWorks. German companies lag behind when it comes to technology competence.

The E-Commerce Magazin has published an exciting article on the topic of technology competence as a growth driver for companies. Why does Germany lag behind in a country comparison? Where are the most technology-competent companies located? Which technology areas deserve special attention? Find out in the following article! You can find the original version here!

Technology-savvy companies pursue ambitious goals with regard to customer acquisition and increasing profitability. In a cross-country comparison, however, decision-makers in Germany are far behind when it comes to confidence in both their own technology competence and that of the company. On a global level, 82 percent of the decision-makers surveyed who attribute strong technology competence to their own company say they expect growth in 2021.

The proportion drops to 50 percent for companies whose technical expertise is lower. The technology-savvy companies are also the ones that plan to expand their business more in the next six months. Compared to the group of companies with low technology expertise, they are more likely to plan to introduce new services (36 percent versus 25 percent), invest in employee recruitment (46 percent versus 34 percent) and expand into new markets (36 percent versus 30 percent).

Decision-makers in Germany with lowest technology competence

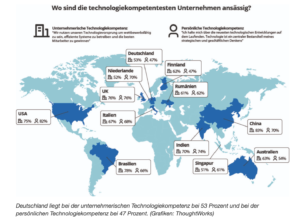

In a country comparison, it is striking that only just over half of respondents in Germany (53 percent) believe that their company makes optimal use of technology to grow the business, operate efficient systems and attract the best talent. This is one of the lowest scores in the study, with only Singapore lower at 51 percent. China has the most positive self-assessment of its own company’s technology capabilities at 83 percent, followed by the UK at 76 percent and the US at 75 percent.

According to the study, a total of almost three quarters of the companies that expect growth in 2021 have decision-makers with a high level of technology expertise. For companies that will not grow, this figure is only 42 percent. German managers see themselves as having some catching up to do in terms of technology expertise. While 82 percent of respondents in the U.S. rate their own technology expertise as very high (76 percent in the UK, 65 percent overall), Germany brings up the rear with 47 percent (together with Finland). With regard to the growth expected for 2021, decision-makers in Germany are also less confident. 63 percent of respondents expect growth, compared to 71 percent overall; US companies are the most optimistic, with 89 percent.

Technology is success factor for customer acquisition and efficiency

Just under half of the respondents state that their top business goal for this year is to increase efficiency. 46 percent want to win new customers and 45 percent want to increase profitability. 62 percent of decision-makers believe that technology is very important in achieving increased efficiency. 59 percent of respondents see technology as an important success factor for customer acquisition.

For German executives, cost reduction is the primary goal (46 percent), followed by efficiency enhancement (42 percent) and customer acquisition and opening up new markets (41 percent each). Increasing profitability is the core objective for only 28 percent of respondents. According to respondents, technology has the greatest positive impact on customer acquisition (65 percent), followed by increasing efficiency (59 percent) and reducing costs (57 percent).

Lack of technological competence in key technologies

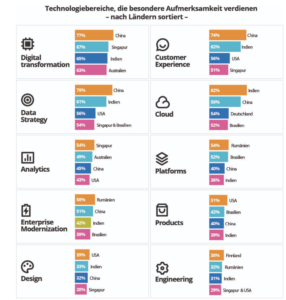

More than half of the respondents see digital transformation as the technology topic with the greatest significance for future company growth. Other growth drivers with just under 50 percent each are customer experience and data strategy. For the respondents from Germany, digital transformation is also the frontrunner with 55 percent, closely followed by the topic of cloud (54 percent); customer experience is in third place (41 percent).

According to the study, executives’ technical know-how for these important topics still has room for improvement. Overall, 44 percent of decision-makers have good knowledge in the area of digital transformation; China is the frontrunner here with 52 percent, while in Germany the figure is 41 percent. For the topic of customer experience, 45 percent are well positioned with their skills; Germany is in the top third with 54 percent. 36 percent of respondents from Germany believe that their management team is well versed in the topic of cloud, which is in line with the country average.

“The results of the study are a wake-up call for companies that underestimate the importance of strategic use of technology for business success,” said Dr. Peter Buhrmann, managing director of ThoughtWorks in Germany. “This is by no means a technical problem that could be fixed by buying new equipment or software. Rather, it is about a cultural change in the company. The pandemic has made us even more aware of the importance of digital transformation. Today’s CEOs need to be as comfortable with cloud, customer experience and data strategy as they are with sales and marketing.”

The study methodology: The data used is based on an online survey conducted by Maru/Blue in February 2021, in which 969 C-level decision-makers (CEOs, CIOs and CTOs) from seven industries in the USA, United Kingdom, Germany, Italy, Romania, Finland, China, Australia, India, Brazil and Singapore participated. As a global technology consultancy, ThoughtWorks combines technology, software, design and strategy to deliver a holistic product experience for its clients.

Find the original article here!