Digitization of the optical industry – an online store analysis of Mister Spex (Part 1)

Introduction

Digital transformation has already taken hold of many industries, including the optical sector. One company that has disruptively changed the market for glasses and vision aids is Mister Spex. Marei Stanetschek, Eliza Karolys and Laura Olesiak conducted an online store analysis of Mr. Spex as part of their media and communication management studies at Fresenius University of Applied Sciences and documented their findings in this article.

Mister Spex – the online store analysis

In 2015, 53.3% of people surveyed in a study still ruled out buying glasses online. Mister Spex has been trying to change this attitude for ten years. With success, because today Mister Spex is the market leader throughout Europe. The company has achieved this, among other things, by combining the advantages of e-commerce with consultation offers with the optician on site with good service. Nevertheless, the question arises as to how successful they really are in doing this and whether the relevant target group of 14 to 49-year-old spectacle wearers see Mister Spex as a serious alternative to the established stationary retail trade. This question is answered in the following three-part online store analysis.

In 2007, founder and CEO Dirk Gabler noted that the eyewear market had not yet been tapped by digitization. The market at that time was dominated by high and non-transparent prices and hardly any emotional buying experiences. These points were the reasons for his vision of a large, immediately available and fashionable range, with a transparent pricing model.

At the same time as Mister Spex, competitors such as Brille24 also discovered the opportunities of the digitalization of the optical market. In our analysis, we look at how Mister Spex manages to defend its market share and where the company’s unique selling proposition lies. For this reason, we examine the business model, online marketing measures and social media marketing, among other things.

However, the main tasks and challenges in the company are the processing of orders and the complex logistics. It is also important for Mister Spex to measure and evaluate key figures such as the conversion rate in order to be able to draw conclusions about measures.

All these aspects will be addressed in this paper to get a detailed online store analysis of Mister Spex. The first part of the three publications deals with the topics: Business model and competitive situation of Mister Spex.

The Mister Spex business model

The business model forms the basis of every profit-seeking company. This chapter uses the Business Canvas model by Osterwalder and Pigneur to clarify where Mister Spex focuses its efforts. The focus is on the value proposition, i.e., the added value offered to the customer by the company.

The development of the sales method – from online store to omni-channel

Mister Spex was originally a “pure player” and thus focused only on its online store. Over time, the company has evolved into a multichannel, with the aim of reaching customers through various sales channels. This process will be discussed in the following subsections.

The origin of the company through the online store

Mister Spex was founded in 2007 by Dirk Grabler in collaboration with Spreadshirt and business angel founder Lukasz Gadowski. Initially, the business model was based on a pure online store, as the founding team realized that the optical industry was not represented in the online world. So they seized the opportunity and launched the first e-commerce store in Germany to buy glasses online. The biggest hurdle was addressing the target audience, as they needed to understand that buying sunglasses or regular vision glasses is not as complex and costly as most potential customers thought. As a measure for this, Mister Spex placed a lot of advertising on television, as this was able to generate the greatest reach at the time and the medium was familiar to customers. To date, the online store has established itself in Germany, France, Spain, Switzerland, Norway, Finland, Sweden, the Netherlands and the United Kingdom.

Expansion through additional cooperation with partner opticians

In 2011, Mister Spex decided to enter into cooperation with partner opticians from the stationary trade. If you are on the Mister Spex website and are looking for a partner optician, you have the option of enabling access to your location, so that the nearest stationary retailer is displayed. If you do not want to do this, you can also enter your location manually, which will show you all partner stores that are nearby.

This measure reduces the risk for uncertain customers who are not yet familiar with shopping for glasses online. At the same time, this optimizes the service provided by Mister Spex, as the customer now has the opportunity to take an eye test on site in the stationary store. Afterwards, the customer can enter the current data in his customer profile on the Mister Spex website and thus has the correct visual acuity stored for future orders. If the customer orders a pair of glazed glasses after the eye test, the price of 9.90 euros for the eye test is refunded. As soon as the delivery arrives, the glasses can still be adjusted free of charge in the stationary trade.

The stationary retailer or the cooperation partner receives 15 euros for each eye test that is registered via Mister Spex, and each adjustment after the purchase is reimbursed by Mister Spex with 5 euros. If the customer buys a pair of glasses from Mister Spex after the in-store visit, the cooperation partner receives a share of sales of ten to 15 percent. In November 2014, the partner program generated 15 to 20 percent of total “glasses” sales. Today, the company works with 550 local opticians in Germany, Austria, Switzerland and the Netherlands.

The Shop in Shop model from Mister Spex

The Shop in Shop model is the deepening of the partnership with the stationary trade, because now the local optician also places glasses from the assortment of Mister Spex in his own store. This means that the entire process – from the eye test to the choice of glasses to the fitting after the lenses have been used – can take place in the local store. The glasses available for selection are selected varifocals from the Mister Spex Collection, which are manufactured in Berlin. The aim of the shop-in-shop model is to further develop the target group, because now customers who are not particularly online-savvy will also be familiarized with Mister Spex, because you no longer have to order the glasses online. This deeper cooperation is advertised through local ads and at Mister Spex on the website. The advantages of stationary trade remain the same as before.

The evolution to omni-channel

In 2016, the multichannel concept, which meant selling products via different sales channels, was expanded even further into an omni-channel. Mister Spex opened its first own offline store in Berlin, giving customers the opportunity to access the entire product range via different channels. Today there are four stores, in Berlin Mitte, in Berlin Staglitz, in Oberhausen and in Bremen. Next year, stores are to be opened in Dortmund and Bochum. Thus, potential customers are addressed through many different sales channels. Whether in one of the 550 partner branches, in the company’s own new offline stores or via the classic original e-commerce store.

The idea of its own stationary store and the internationalization of the website in Europe also increased the complexity of the company and Mister Spex decided to change its system. The company switched to Intershop Commerce Suit, which is an independent provider for the implementation and design of omni-channel commerce and thus also forms the interface to the store system. Among other things, this allows Mister Spex to centrally manage its 240,000 product variants, update all product data and distribute it to the various sales channels. Customers can now start their shopping experience in the brick-and-mortar store and theoretically finish it in the online store from home, since the brick-and-mortar store and the online store are linked by Intershop.

The customer and target group analysis of Mister Spex

Besides the business idea, it is most important for a company to know its potential target group. After its vision to digitalize the optician market, Mister Spex conducted a detailed market analysis to see how big the potential is and who its future customers might be. The target group analysis is elementary for the alignment of its products, the usability and for example the advertising to the target group.

Customer Segments

The market analysis by Mister Spex revealed that 43 million Germans need visual aid. Of these, just under five percent use contact lenses, which means that around two million people over the age of 14 wear contact lenses. Almost 61 million people in Germany own sunglasses. This results in the customer potential in Germany and the offer of Mister Spex: they sell glasses, varifocals, sunglasses and contact lenses and thus theoretically cover the entire market demand. In 2013, a representative survey conducted by the TNS Infratest institute announced that Mister Spex, in Germany, is the best-known Internet provider of glasses, sunglasses and contact lenses, as they achieve circa 55% supported brand awareness among 14-49 year old Internet users who need glasses. This age group is therefore one of Mister Spex’s target groups. The 14- to 29-year-olds form a focal point of this, as they achieve the highest value for supported brand awareness.

In order to distribute the products best, a company must know how large the potential is. This question was clarified at the beginning of this subchapter. Now one must divide these potential customers, if possible, into groups or segments. In principle, there are three different buyer groups when you consider the place of purchase. The first group of buyers has an affinity for online shopping, which means they prefer to store online, while the second group is more traditionally inclined and prefers to buy in brick-and-mortar stores. The last group of shoppers mixes both variants, as they like to look at products on the Internet because of the price transparency there. Nevertheless, they also need personal contact in the store and the opportunity to take a closer look at the product. That’s why Mister Spex has opted for the multichannel concept over the course of time, because it allows each individual buyer group to be addressed via different sales channels.

All about customer relationship

With customer relationship management, Mister Spex attempts to bind new customers to the company or to deepen and solidify the relationship with existing customers by meeting their needs and desires. Mister Spex pursues various strategies for this purpose:

One is direct communication as a service. If customers have questions or problems, they can reach employees via a free customer hotline, from Monday to Friday from eight to 8 p.m. In addition, Mister Spex has a callback service if the waiting time is too long. Furthermore, there is still the possibility to reach staff via the email address service@misterspex.de. Lastly, there is also a FAQ page where users can find answers to frequently asked questions. Most customers are used to 24/7 customer service nowadays, as many transactions are done on weekends or evenings, so this service should be standard.

However, customer relationship includes not only crisis management, but also the appearance on social media platforms and the flow of information from the company to the customer. Mister Spex is represented on Facebook, Twitter and Instagram as well as Google+, which will be discussed in more detail in chapter six. In addition, they have a blog for their customers with the latest events, as well as a newsletter that regularly informs about offers and promotions.

The third point is the ease of shopping, which includes, for example, the usability of the website or the other sales channels. As described in chapter 2.1, there is the website, the partner optics, and own stationary stores. For example, the company offers various payment options and additional free services, such as free shipping, eye tests and eyeglass fittings through the partner opticians. The topic is discussed in more detail in chapter seven, as we did a self-test by ordering a pair of glasses from Mister Spex and sending them back.

The value proposition of the company

The value proposition forms the center of the business canvas model. It is Mister Spex’s value proposition to the customer through its services and products.

The best price guarantee is particularly important to Mister Spex, as the founders had the vision of improving the shopping experience through price transparency and price savings. This is one of the biggest advantages for customers, any price difference is refunded within 30 days. Eyeglasses with prescription are up to 60 percent cheaper than the manufacturer’s recommended retail price. Likewise, there is a glasses and sunglasses outlet where the remaining stock is offered again 45% cheaper.

In addition to the good prices, Mister Spex has the largest assortment of immediately available brand and sunglasses in all of Europe. They have over 5,500 different glasses, sunglasses and sports glasses from more than 90 brands and designers, plus they have all the contact lenses and care products from the relevant manufacturers. Thus, they create a fashionable and extensive assortment where every customer can find what they are looking for and have a positive shopping experience.

These two points are rounded off by the various advantages that have already been mentioned in the topic of customer relationship management, such as the various sales channels and the free additional services.

The business model summarized in the business canvas model

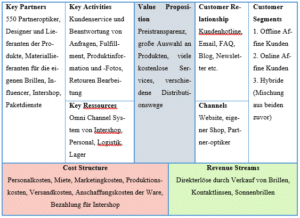

The remaining points of the Business Canvas Model are derived from the Customer Segments, Customer Relationship and Channels (the sales channels) described above, together with the Value Proposition.

The Key Activities of Mister Spex include order processing, operating the website, and any customer service to satisfy the customers. However, the main task is to answer inquiries and process orders. This is accompanied by fulfillment, which includes all steps from the conclusion of the contract. In addition to the orders, the returns must also be processed in a timely manner, of which there are also many according to our assumptions, since one can order up to four pairs of glasses to try on. When Mister Spex adds new products to its range, product information and photos must also be added immediately.

As Mister Spex has evolved over time into an omni-channel, its system is now managed by Intershop, so this system is one of the most important resources as it connects website and brick-and-mortar retail. Besides, the staff is indispensable for customer service, for consultations, as well as for many other areas of the large company, so it is also one of the most important resources. In addition, there are the logistics, the warehouse and Mister Spex’s own workshop, which will be discussed in more detail in chapter seven.

The key partners include the 550 partner opticians and the designers and manufacturers of the

designers and manufacturers of eyeglasses, sunglasses and contact lenses, who are represented in their own stores and on their website. For the glasses from Mister Spex’s own production, material suppliers are also needed above all and are therefore also considered Key Partners. Parcel services ensure smooth distribution to the customer, and software providers such as Intershop network the entire Mister Spex store system.

This results in the following cost structure: Mister Spex has to pay the external service providers such as Intershop for the store system and tracking tools, and the company also has to pay its personnel costs of EUR 11,835,000 and the rent for its own stores, the warehouses and for the workshop. In addition, there are marketing costs for TV advertising and other promotional activities, for example. Production costs are also incurred for the manufacture of its own eyewear, as well as acquisition costs for the branded eyewear that is sold. Since Mister Spex offers free shipping, they must also cover these costs. The balance sheet for the fiscal year shows, among other things, material costs for raw materials and supplies and purchased goods in the amount of 32,065,000 euros.

These costs must be covered by the sale of eyeglasses, contact lenses and sunglasses. Thus the incomes are formed only from the direct proceeds. At this point, one can add that Mister Spex also has many investors such as Scottisch Equity Partners, Goldman Sachs, XAnge, DN Capital and High-Tech Gründerfonds.

Tab.1: Business Canvas model according to Osterwalder and Pigneur for Mister Spex (Source: Own representation)

The competitor analysis of Mister Spex

The competitive analysis belongs to the external analysis, through these opportunities and risks turn out, which you have to use as a company, or convert or if necessary bypass. Through the competitors also results in the own market share, so that you can see whether you dominate yourself or another competitor. In the following part, the optics market is examined, with a focus on the strongest competitor and, finally, the strongest competitor in relation to the stationary trade.

The market share and competitive situation of Mister Spex

Due to digitization and price transparency, competition in the online optical market is much more intense than in brick-and-mortar retail, making unique selling propositions all the more important. How Mister Spex is positioned and who its competitors are is discussed in the following part of the online store analysis.

If you enter the keyword “buy glasses” in the Google search bar (22.07.2017), you already get an overview of the most important market participants on the first display page. The first four paid ads are distributed as follows: Mister Spex occupies first place, followed by brille24, my-spexx and visionet-online in fourth place. The first place in organic search is also occupied by Mister Spex, followed by Edel-Optics, Brillenplatz, Brille24, Fielmann, Brille-kaufen, Brilledirekt, Netzoptiker and My-Spexx. These ten companies, among others, make up the most important market players.

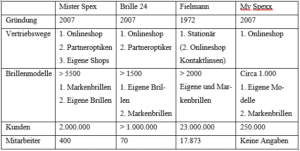

In order to get a small overview, some data of Mister Spex, its strongest online competitor Brille24, Fielmann which is Germany’s largest stationary retailer and My Spexx, also an online store, which was founded at the same time, are shown here.

Based on table two, it is clear that Mister Spex is in first place in terms of competitive position in online retail. It is striking that every company with an online store was founded in 2007, so many saw an opportunity in this market, which has not yet been digitized. You can also see the gradation of sales channels, Mister Spex clearly offers the most models, which appeals to many customers. Brille24 also has partner opticians, just like Mister Spex. My Spexx, however, is limited to pure e-commerce, which could be the reason for the low number of customers, whereby they have not managed to assert themselves as Mister Spex and Brille24. In 2015, the total turnover of the online optician industry was 250,000,000 euros and Mister Spex had a turnover of 60,873,000 euros according to its 2015 balance sheet. Now, based on the figures, one can estimate the market share of Mister Spex, as it is not published. The market share is calculated by its own turnover divided by the total turnover of the industry. This gives us a market share of around 24.4 percent.

Tab. 2: Comparison of competitors (source: own representation)

Mister Spex’s biggest competitor

Brille24 is Mister Spex’s strongest competitor. Initially, both pursued different strategies and therefore had the opportunity to address different customer segments without getting in each other’s way. This allowed both companies to grow well, even though they started at the same time. Brille24 did not initially have any branded eyewear in their range, this changed when they bought up the online store Optik24Plus, as they offered branded eyewear. Mister Spex sold branded glasses from the beginning and only launched a Mister Spex Collection in the following years. Today, both company strategies are very similar, after Mister Spex started the cooperations with retailers, Brille24 entered into a cooperation with Rewe. However, it quickly became apparent that Mister Spex could bring greater added value to customers through the expertise of stationary opticians. Thus, Brille24 adopted the idea with partner opticians. However, Mister Spex still has some unique selling points that set it apart from Brille24, which is also supported by its good positioning, as Mister Spex is in first place in both paid and organic hits, as previously mentioned.

Mister Spex has the most extensive offer compared to the entire market, whether online or stationary. They offer over 5500 products, almost four times what Brille24 offers. In addition, Mister Spex is the only original online company that has opened four brick-and-mortar stores to date and they were also the first with the idea of partner optics, thus they have offered great value to customers. The most important thing is that they also have the most customers compared to the online competition, they have twice as many customers as Brille24, although they are now both following the same strategy. Thus, they take away each other’s customers, as the target groups of both overlap.

If you compare the figures of Brille24 and Mister Spex, you can also see clear differences. Brille24 has 433.96K total visits, a customer calls up an average of 8.6 pages during a session and they have a bounce rate of 36.81 percent. Mister Spex has 1.28M total visits, a customer calls up 13.17 pages per session on average and the bounce rate is 25.49 percent. These numbers also prove that Mister Spex is more successful. They have more traffic on their website and yet a lower bounce rate, and customers stay longer on their site.

Stationary competition is also important, because in 2015, 5.8 billion euros were generated by the optical industry, of which approximately four percent was generated by online stores, although the prices in online stores for simple single-vision glasses are on average 30 to 50% cheaper. The premium can be justified in the stationary trade by higher fixed costs and the consultation by the personnel, which the customers are ready to pay. This can be seen from the high difference in the percentage sales of online stores compared to stationary retail. Fielmann is Germany’s largest stationary retailer. The company has a market share of just under 50 percent when it comes to the entire optical market and is growing twice as fast at five percent compared to its stationary competitors. Online retailers, on the other hand, are growing at an average rate of six times faster than bricks-and-mortar retailers.

Authors:

Marei Stanetschek, Eliza Karolys, Laura Olesiak

Sources:

Birger, N. [2015] Welt, verfügbar unter: https://www.welt.de/wirtschaft/article144233612/Warum-Optiker-um-ihre-Lizenz-zum-Gelddrucken-bangen.html (20.07.2017)

Dier, M. [2013] Aktuelle Umfrage bestätigt: Mister Spex ist Deutschlands bekanntester Online-Optiker, verfügbar unter: https://corporate.misterspex.com/wp-content/uploads/2015/10/2013-08-21-PM-Mister-Spex-laut-TNS-Umfrage-Deutschlands-bekanntester-Online-Optiker.pdf (20.07.2017).

Intershop [o. J.] Mister Spex mit klarer Vision: Vom Web-Shop zur Omni-Channel-Strategie, verfügbar unter: https://www.intershop.de/files/Intershop/media/downloads/de/success-stories/de_MisterSpex.pdf (21.07.2017).

Luiza [2016] Corporate Mister Spex. News Blog, verfügbar unter: https://corporate.misterspex.com/de/blog/mister-spex-wollte-es-genau-wissen-alle-zahlen-und-fakten-ueber-sonnenbrillen-und-kontaktlinsentraeger-in-deutschland/ (20.07.2017).

Meixner, S. [2014] Neuhandel, verfügbar unter: http://neuhandeln.de/mister-spex-verraet-details-zu-seiner-multichannel-strategie/ (19.07.2017).

Meixner, S. [2015] Neuhandel, verfügbar unter: http://neuhandeln.de/mister-spex-startet-ein-shop-in-shop-konzept-fuer-optiker/ (19.07.2017).

Mister Spex GmbH [2017] Bundesanzeiger. verfügbar unter: https://www.bundesanzeiger.de/Ebanzwww/wexsservletsession.sessionid=0f0f9b23909d800629c73e91f9e32c0d&page.navid=detailsearchlisttodetailsearchdetail&fts_search_list.selected=3a9f7486ab40f1da&fts_search_list.destHistoryId=01148 (15.07.2017).

Mister Spex [o. J.] Coporate Mister Spex. Über Uns, verfügbar unter: https://corporate.misterspex.com/de/ueber-uns/wer-wir-sind/company-story/ (22.07.2107).