The Customer Lifetime Value Calculation

Calculating customer lifetime value (CLTV) is worthwhile because this indicator has a high potential for success. It is therefore also worthwhile to place CLTV at the center of e-commerce controlling. In this article, I show how customer lifetime value is calculated, how the Data basis is determined, and which control potentials arise with customer lifetime value.

Do you need help with customer retention and determining the customer lifetime value for your online store? Then take advantage of the short line to Prof. Große Holtforth: Tel. 0221 97319936, mail: info@ecommerceinstitut.de. The video gives you a first overview of the Customer Lifetime Value:

Contents

Customer Lifetime Value calculation – the definition

Customer lifetime value is the net contribution margin generated by purchases from a single customer during a given period, the customer lifetime. The Customer Lifetime Value model assumes that, after an acquisition, a customer remains loyal to a company for an extended period of time and purchases goods or services from that company. The basis for the customer lifetime value model is therefore the loyalty of the customer. The customer lifetime value calculation compares the present value of a customer’s net contribution margins with the costs of the initial acquisition.

Customer Lifetime Value calculation – the formula

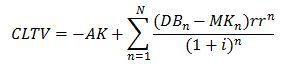

The following equation can be used to calculate the Customer Lifetime Value:

- AK the acquisition cost for the individual customer,

- DB the contribution margin I,

- MK the marketing and customer care costs,

- rr the retention rate or repurchase rate,

- i a discount rate and finally

- n the respective period under consideration,

- N the total number of periods taken as a basis.

- Customer lifetime value calculation

Customer Lifetime Value calculation – an example

Assume that a customer usually spends 200 € per year with a company, resulting in a contribution margin I of 80 €. The acquisition costs are one-time 50 €, the annual direct costs of customer care etc. are 10 €, the retention rate is 85%. The customer retention period is assumed to be 5 years, the interest rate is 5%.

This results in the Customer Lifetime Value calculation:

CLTV = – €50 + €194.07 = €144.07

It is clear that due to the high costs of acquisition, limited customer loyalty and also discounting, the Customer Lifetime Value as a present value is characterized by a considerable number of negative factors. However, it is the merit of the CLV model to provide an objective indicator for these factors and for determining the present value of the customer relationship. This present value is particularly important for determining the budget for customer acquisition.

Customer Lifetime Value calculation – the practice

Since customer lifetime value is a composite indicator, it is relatively complex to determine. At the same time, the Customer Lifetime Value is oriented towards the future and therefore predominantly contains planned figures. Finally, different data sources are required, which must provide consistent data among each other.

The data sources for Customer Lifetime Value

The Customer Lifetime Value contains data from several sources that have to be combined. First, controlling and accounting provide data on the contribution margin and the discount factor. CRM provides information on the retention rate and on marketing and customer retention costs, while online marketing can provide information on online acquisition costs.

Since all data is planning data, the individual plans must be coordinated. The assumptions about exogenous factors of the planning must be synchronized, likewise, endogenous planning parameters must be coordinated. Since planning is usually based on historical values, the individual data sources must be able to access the respective historical values.

Aggregated or individual data

One question of complexity and the required capacity to manage complexity is the question of aggregating data. Customer lifetime value can be determined on an individual basis, i.e. for individual customers, or – in the sense of a simplified lump sum – via aggregates. Aggregates – e.g., the “average male customer” – have the advantage that they can be determined much more easily, but aggregation inevitably means a loss of information.

On the other hand, individual data makes it possible to continuously check and adjust the underlying model for customer lifetime value. With the help of individually collected data, aggregations can also be carried out more easily. However, the collection of individual CLTV data is very time-consuming and requires the customers’ consent in a special way.

Customer lifetime value calculation – segmentation as a compromise

Due to the difficulties with either highly aggregated or individual data, segmentation is – as is often the case – the ideal solution. In segmentation, customers with identical and typical characteristics are grouped into segments for which the customer lifetime value is then calculated.

Segments can be defined according to demographic characteristics such as age, gender, place of residence or educational status. But online channels or the use of different devices can also shape the definition of segments. Finally, situational segments can also be used, for example, when campaigns and actions are carried out to support customer loyalty.

Customer Lifetime Value Calculation – Challenges in Calculation

The calculation of customer lifetime value is based on a number of model-like hypotheses, which make the calculation of this indicator a challenge for data analysts. Particularly difficult are the flat ratios acquisition costs, retention rate, discount rate but also the underlying length of customer retention.

Determining acquisition costs

The customer lifetime value model assumes that no further acquisition costs are incurred after a customer has been acquired for the first time. However, this ignores the fact that regular customers can also use channels that can lead to direct marketing expenses. If the customer lifetime value is to be determined on a granular basis, i.e. for individual customer segments, these subsequent acquisition costs must be taken into account.

Typical acquisition costs include click costs for Google Adwords. To determine the effective acquisition costs, the cost-per-order or cost-per-acquisition can be determined with a simple formula. This requires an average click cost rate, the CPC, and the average conversion rate. This results in the value for the acquisition costs:

CPO = CPC/CR.

An example makes the connection clear. With an average CPC of 0.75 euros and a conversion rate of 3%, the CPO is 25 euros. The example makes it clear that acquisition costs in online marketing can be considerable even with moderately positive cost figures.

Determining the retention rate

Furthermore, determining a retention rate for the entire duration of the customer relationship is problematic. A more realistic approach would be to consider a dynamic progression of the retention rate. It would be plausible to assume that the probability of repurchase decreases over time. Certainly, the question of whether the company’s product range consists more of consumer goods or of durable goods is also relevant.

Determining the discount factor

The discount rate also has a significant influence on the level of the customer lifetime value, but can only be determined with the help of forecasts. The interest rate should reflect the cost of capital and the risk that the customer will drop out after all. In this case, the acquisition costs cannot be amortized and must be written off.

Determining the customer retention period

The customer retention period significantly determines the customer lifetime value. In determining this figure, the company therefore relies on having valid historical values that allow it to determine an average customer retention period. However, if customer retention measures are intensified, which also extend the customer retention period, the overall model could appear less reliable.

Customer lifetime value calculation – corporate management with the CLTV

Despite all the difficulties that arise in determining the Customer Lifetime Value, the model is well suited for carrying out profit-oriented corporate management.

The main contribution of the Customer Lifetime Value model to revenue management lies in the segmentation of customer groups. If customer groups are differentiated according to their expected CLTV, online marketing measures and investments can be carried out more efficiently. A proven approach is the grouping of customer segments within the framework of an ABC distribution. This is similar to the Pareto principle, also known as the 80/20 rule: 20% of the customers represent 80% of the contribution margins.

Furthermore, it is obvious to intensify customer loyalty measures for customers with a high CLTV. The effect of discounts and other promotions on contribution margins can also be determined with the help of the Customer Lifetime Value. Finally, the model is an important basis for allocating the budget for customer service and customer loyalty measures.

Conclusion

Even though the Customer Lifetime Value model is somewhat complex, it has many applications and provides important insights that should not be ignored in online marketing and e-commerce. If you also consider that customer lifetime value is the central indicator at amazon – especially for Prime customers – it becomes clear that for many e-commerce companies it makes sense and is necessary to address customer lifetime value from a strategic and cultural perspective.

Author: Dr. Dominik Große Holtforth

Photo: Copyright Rawpixel@Shutterstock.com

Literature: Jeffery, Mark: Data-Driven Marketing. The 15 Metrics everyone in Marketing should know, Hoboken 2010, p. 134 ff.