Bitcoin Wealth Is Becoming More Evenly Distributed Over Time 2/4

Bitcoin Wealth Is Becoming More Evenly Distributed Over Time

Widespread Estimates Of Individual Bitcoin Ownership Concentration Are Oversimplified And Irrelevant.

This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice.

Before reading the second part of the article, you can find the first part of the article here.

[…]

3. Analysis of commonly cited news regarding Bitcoin wealth concentration

Unfortunately, some journalists have published drastically simplified conclusions in the past.

Those statements have since spread like wildfire. Fortunately, repeating wrong numbers on a regular basis does not make them magically come true. In this chapter, we will look into three of those numbers circulating throughout the web when it comes to Bitcoin ownership concentration.

3.1. Claim 1: “2% of Bitcoin holders control 95% of the current supply”

Interpreting Bitcoin data in an oversimplified manner results in wrong conclusions, which results in false narratives. Which in return influences and shapes the opinions of unsuspected readers. An example of this is the highly misleading claim that 2% of Bitcoin holders control 95% of the current supply. This claim has been published in some of the most well-known media outlets of the world:

The Economist – 7th December 2021:

About 2% of bitcoin accounts hold 95% of the available coins, according to Flipside, a crypto-analytics firm.71

Bloomberg – 18th November 2020:

A few large holders commonly referred to as whales continue to own most Bitcoin. About 2% of the anonymous ownership accounts that can be tracked on the cryptocurrency’s blockchain control 95% of the digital asset, according to researcher Flipside Crypto.72

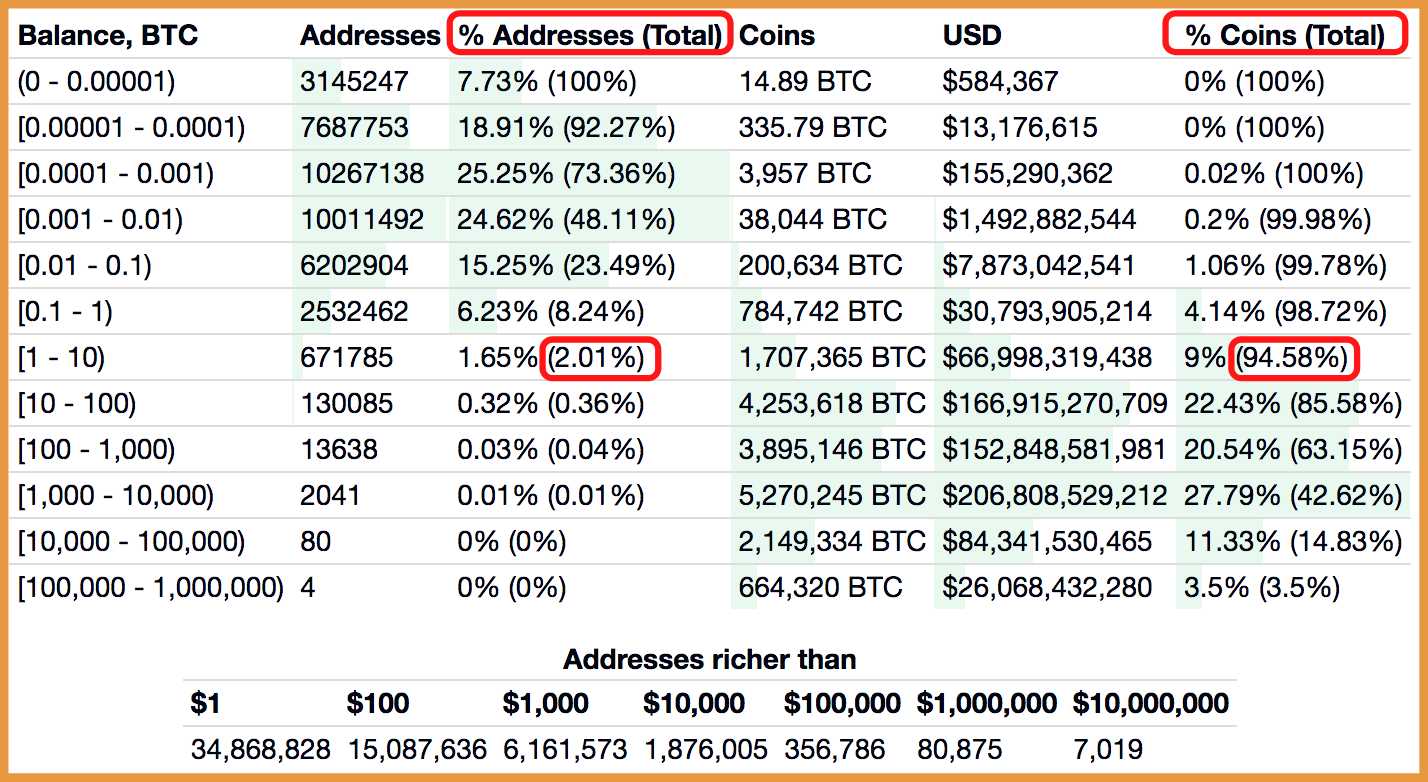

To approach individual Bitcoin ownership in a somewhat professional manner, several variables have to be accounted for as outlined in the previous chapter. In this case, not a single variable was included. Instead, the figures are based entirely on a graph73visualizing the holdings of the top 2% of addresses in the Bitcoin rich list (image below).74

The Bitcoin rich list simply shows the holdings of Bitcoin addresses – the statement that 2% of addresses control 95% of the supply is true (circled red), but misleading and irrelevant. For comparison, it wouldn’t be fair to conclude that over 97% of the global money stock is owned by a few entities, simply because physical cash accounts for less than 3% of the money in the economy (and only this form of money can currently be held by individuals in the first place without third parties such as banks).75

Raphael Schultze-Kraft, CTO and Co-Founder of Glassnode – a company specialized in data analytics and visualizations of the blockchain – refutes this misleading claim in a well-documented article on the company’s blog.76 The upper bound of individual ownership is that 2% of BTC users hold 71,5% of the circulating supply (instead of 95%).

The […] figures are an estimate for an upper bound of the true distribution of Bitcoin ownership. We expect the actual distribution to be more evenly distributed across entity sizes.

For example, he does not factor in custodians, lost coins, and wrapped BTC. Pushing towards a lower bound might even get you below 50%, which is better than the current global wealth distribution – highlighted in chapter 6 of this article.

3.2. Claim 2: “1,000 people own 40% of all Bitcoins”

Business Insider – 27th of February 2021:

There are around 1,000 individuals, known as whales, who own 40% of the market.77

These numbers were wrong a year ago and still are today. Unfortunately, the author does not reveal the methodology in how she came up with these results. In her article, she also refers to a piece published a month earlier in The Telegraph:

The Telegraph – 22nd of January 2021:

The top 40pc of all Bitcoin, roughly $240bn, is held by just under 2,500 known accounts out of roughly 100m overall.78

The author of this second article links his figures to “industry data”, but it remains unclear which “industry data” these figures rely on. Ignoring the fact that the numbers of both articles vary wildly from one another, the authors do not take into account a single one of the variables mentioned in chapter 2 of this article.

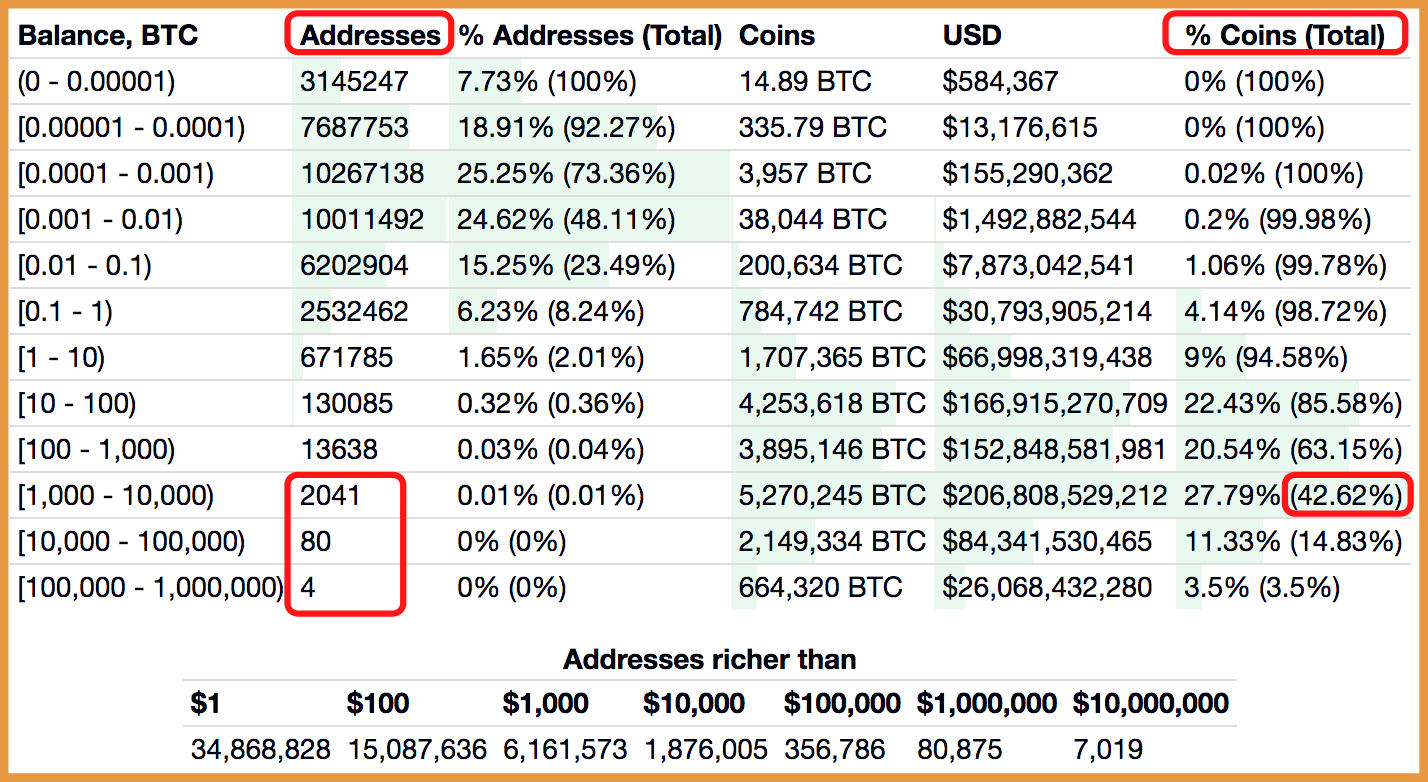

The only explanation I found for the “top 40pc of all Bitcoin […] is held by just under 2,500 known accounts” claim is again the Bitcoin rich list. The numbers on the left and right of the image framed in red are close to the claim cited above. The claim that 1,000 people own 40% of the Bitcoin market, on the other hand, is so remarkably false that I cannot explain it even when ignoring all variables outlined in chapter 2. Perhaps the author based her findings on old figures from several years ago, because – as we will examine in chapters 4 and 5 – individual Bitcoin holders’ wealth was far more concentrated in the past.

3.3. Claim 3: “0,01% of Bitcoin holders control 27% of the current supply”

In a recently published article in the Wall Street Journal, the author claims that 27% of the current Bitcoin supply is held by the top 0,01% of holders.79

In the article, he refers to the non-peer-reviewed working paper published via the National Bureau of Economic Research (October 2021), which was not linked. The paper does not mention these numbers anywhere, as you can verify by reading through the 55 pages yourself.80 Additionally, the working paper is “circulated for discussion and comment purposes”, as stated directly on the cover page. It becomes clear that the paper has not been peer-reviewed when stumbling upon spelling mistakes to an extent that Satoshi Nakamoto is declared to be the “Bitcoin investor” instead of the “Bitcoin inventor”.81

Reading through the paper, the authors have not only presented a method of address-clustering, but they also accounted for many exchange wallets (393 in total) and several other important variables (e.g. 86 gambling sites, 39 online wallets, 33 payment processors, and 63 mining pools) which can skew the distribution metrics significantly. Of the total 2,258 rich addresses that hold a minimum of 1,000 Bitcoins each, they identify that less than 50% of them belong to individuals.82

All in all, I would suggest that this working paper is a good attempt at achieving the impossible: Analyzing the Bitcoin ownership concentration of the “Bitcoin elite”. Summarized in one sentence, the authors state that 10,000 individual Bitcoin investors hold ~5 million BTC. But some variables listed in chapter 2 are missing in the paper.

One of the largest missing variables in their calculations are “lost” Bitcoins – or Bitcoins that cannot be moved anymore (described in 2.7.). The authors refer to them as “forgotten” Bitcoins but don’t subtract them in their final conclusion. Additionally, they may have clustered some addresses too aggressively: Ascertaining that an address belongs to an individual investor because it “acts” like one, is speculative. One cannot assume that every not-yet-identified custodial wallet address automatically translates to be interpreted as the account of a single investor.Additionally, I cannot tell if they accounted for wrapped BTC (described in 2.8.), of which all 265,000 BTC are held in those 2,258 rich addresses they are analyzing. These and other variables – admittedly – are very hard to factor in without adding speculative measures to some degree. But that’s essential: No precise number can be given – instead, numbers should be presented with an upper and lower bound.

The author of the WSJ article takes those findings and further calculates some numbers himself, which he explains in his short article, by doing the following:

- 10,000 entities hold ~5 million Bitcoins (as stated in the paper on pages 6 and 29)

- ~114 million individual Bitcoin users as of the time the working paper was published (report by crypto.com – page 8)83

- 10,000 divided by 114 million = ~0,01%

- 5 million divided by 18,9 million (circulating supply at the time) = ~27%

Given the beforementioned complexity of estimating individual Bitcoin holders’ concentration, I will not go over my head just to present the reader with “my specific numbers”. It must be acknowledged, that we cannot pinpoint the exact distribution.

Estimates vary wildly depending on the methodology used

The numbers (0,01% control 27%) can be reduced quite easily – and that goes without changing the flawed methodology outlined in the last paragraphs. For example, by simply factoring in the variable “Lost Bitcoins” at its upper bound of 3,7 million,84 the results would disperse significantly. The paper excludes Satoshis coins in its calculations (1 million BTC), so these should already be subtracted from the upper bound of lost Bitcoins as well:

3,7 – 1 = 2,7 million BTC

Especially in the early days, people lost large BTC amounts. It was basically worthless and was easily forgotten on an old hard drive or scrap of paper.85

Assuming that half of the lost Bitcoins belong to the higher entity bucket, we would need to subtract a whopping 1,35 million BTC from the top 10,000 “individual” Bitcoin holdings, resulting in ~19,3% instead of 27%. Global wealth distribution, in comparison, is at ~11% for the top 0,01% (and 6% for the top 0,001%) according to the World Inequality Report of 2022.86 We could also factor in wrapped BTC and many other variables to further skew the distribution numbers dramatically. If someone would want to present a number that “favors Bitcoin”, you could bring that number below 10%. When adjusting the methodology (e.g. not-yet-identified custodial wallet addresses do not automatically mean they are the addresses of single investors), the number of BTC controlled by the 0,01% would be further reduced.

Unfortunately, the claim that precisely 27% of Bitcoins are controlled by 0,01% of individual Bitcoin holders has spread throughout the internet. Note that the working paper was already published two months prior to the WSJ article I refer to above. However, on the same day, the WSJ article was published, the same numbers were cited by other online media outlets such as Fortune.com.87 Within a day, you would find the numbers spread far and wide:

- Germany: ”0.01% of bitcoin holders control 27% of all coins: study” (Cointribune)

- Austria: “Bitcoin 100 times more unfairly distributed than US dollars” (Der Standard)

- Netherlands: ”27% of all bitcoins owned by just 0.01%” (Crypto Insiders)

- Nigeria: “0.01% of bitcoin holders control 27% of the currency in circulation” (Nairametrics)

- UK: “Top 0.01% of Bitcoin holders control nearly a THIRD of the digital currency worth $232 billion in a dangerous level of concentration, study finds” (Daily Mail)

In the next chapter, we will dive into Bitcoins’ early distribution history – how everything began. Understanding Bitcoins’ genesis and early distribution history, in combination with the chapters that follow, is crucial. It paints a picture that helps us understand that the current distribution of Bitcoin – even if the wild numbers we encountered in the last chapter were proven true – is entirely irrelevant.

4. Bitcoins early distribution history

Satoshi Nakamoto published the Bitcoin whitepaper on the 31st of October 2008, in which Bitcoin is described as a new electronic cash system that’s fully peer-to-peer, with no trusted third party.88 No Bitcoins existed at the time, the total supply was zero. Months before the launch of the Bitcoin experiment, the information was publicly available on the internet.

Satoshi gave everyone a two month heads up before mining the Genesis block, reaching out to the only other people who would possibly be interested in experimenting with a sovereign digital currency at the time, the cypherpunks (via public e-mail list).89

On the 3rd of January 2009, the pseudonymous inventor mined the first Bitcoin block (also known as the Genesis block) for which he was rewarded 50 BTC90 to the address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa.91

The block subsidy (50 BTC) received by this address cannot be spent – it remains unclear if this was done on purpose or by accident.92 Although he could have continued mining 50 BTC roughly every 10 minutes from then on, it took him a full six days to mine the second block.93

Timestamps for subsequent blocks indicate that Nakamoto did not try to mine all the early blocks solely for himself.94

No pre-mining95 took place, there were no private or public pre-sales96 and every Bitcoin was worthless at the time. The supply started at zero and every Bitcoin in existence – until today – had to be mined via the proof of work algorithm. More than two years went by until one Bitcoin was worth 1 US Dollar.97 Of all cryptocurrencies in existence today, Bitcoin is naturally the only one where early adopters/investors could not realistically expect to make profits: It was the first-mover (no prior history of crypto to base your investment case on) and worthless for over two years.

The early pioneers were the ones crazy enough to take the financial, temporal and social risks to participate in the Bitcoin project, keeping it alive and acting as arbiters of the system in its early days.98

All other cryptocurrencies started at a price above zero (including other pioneer projects like Dogecoin at $0.0005599 in 2013 and Ethereum at $0,31 in 2014).100Bitcoin’s distribution process was completely open and Satoshi Nakamoto has never cashed out or used his ~1.125 million coins (an exception being the first Bitcoin transaction worth 10 BTC on the 10th of January 2009 to Hal Finney).101

This selflessness has not been replicated by almost any other cryptocurrency, where the founders usually grant themselves large amounts of a coin before the project is even launched, and then sell the token at its peak to realize a large profit.102

The initial miners spent energy mining 2-3 million coins which were worth nothing. Those who risked capital on those initial endeavors should be rewarded. Satoshi then decreased his hash rate over time and hasn’t come back to touch those initial coins:

Once the network grew and more miners joined, it appears that Nakamoto stopped mining in May 2010. “The timing of the shutdown, the mining behavior, the systematic decrease in mining speed and the lack of spending strongly suggest that Satoshi was only interested in growing and protecting the young network”103

The inventor had made Bitcoin the fairest launch that you could conceptualize.

The only real hurdle was knowledge of Bitcoin’s existence, a hurdle which the Bitcoin community has worked hard to eliminate.104

The extreme price volatility since Bitcoin first started trading on exchanges – with its boom and bust cycles – continues to create headlines in newspapers around the world on a regular basis, resulting in a 24/7 free and global marketing campaign for Bitcoin which every PR agency could only dream of achieving for their clients.

Bitcoins’ early distribution history is an interesting and important topic to learn about – this chapter could easily be extended by several paragraphs – but I will leave it as it is for now. If you want to learn more about the early distribution process of Bitcoin, I recommend reading Lyn Alden’s article titled “Bitcoin: Addressing the Ponzi Scheme Characterization”.105 She also dismantles the widespread myth that Bitcoin is a “Ponzi scheme” in her article, a common misconception upheld and perpetuated by people with little to no Bitcoin knowledge.

Hat Ihnen der zweite Teil dieses Artikels gefallen? Freuen Sie sich auf den dritten Teil!

Weitere Informationen über den Autor -Michael Weymans- erhalten Sie hier auf LinkedIn.

Ein bereits veröffentlichter Artikel dieses Autors, finden Sie hier.

Original source: https://blog.bitbeginner.com/p/70b13407-7a78-4e56-acd1-e1365b8adbd9?s=r